In today’s hyper-competitive business environment, IT, analytics, and data functions are no longer just support arms – they are core drivers of growth, innovation, and customer experience. As organizations seek to unlock value from technology and data at scale, the way they engage with external service providers is evolving rapidly.

Gone are the days when a single outsourcing contract sufficed. Instead, we’re seeing flexible, outcome-oriented, and co-ownership-driven operating models that deliver speed, scalability, and sustained impact.

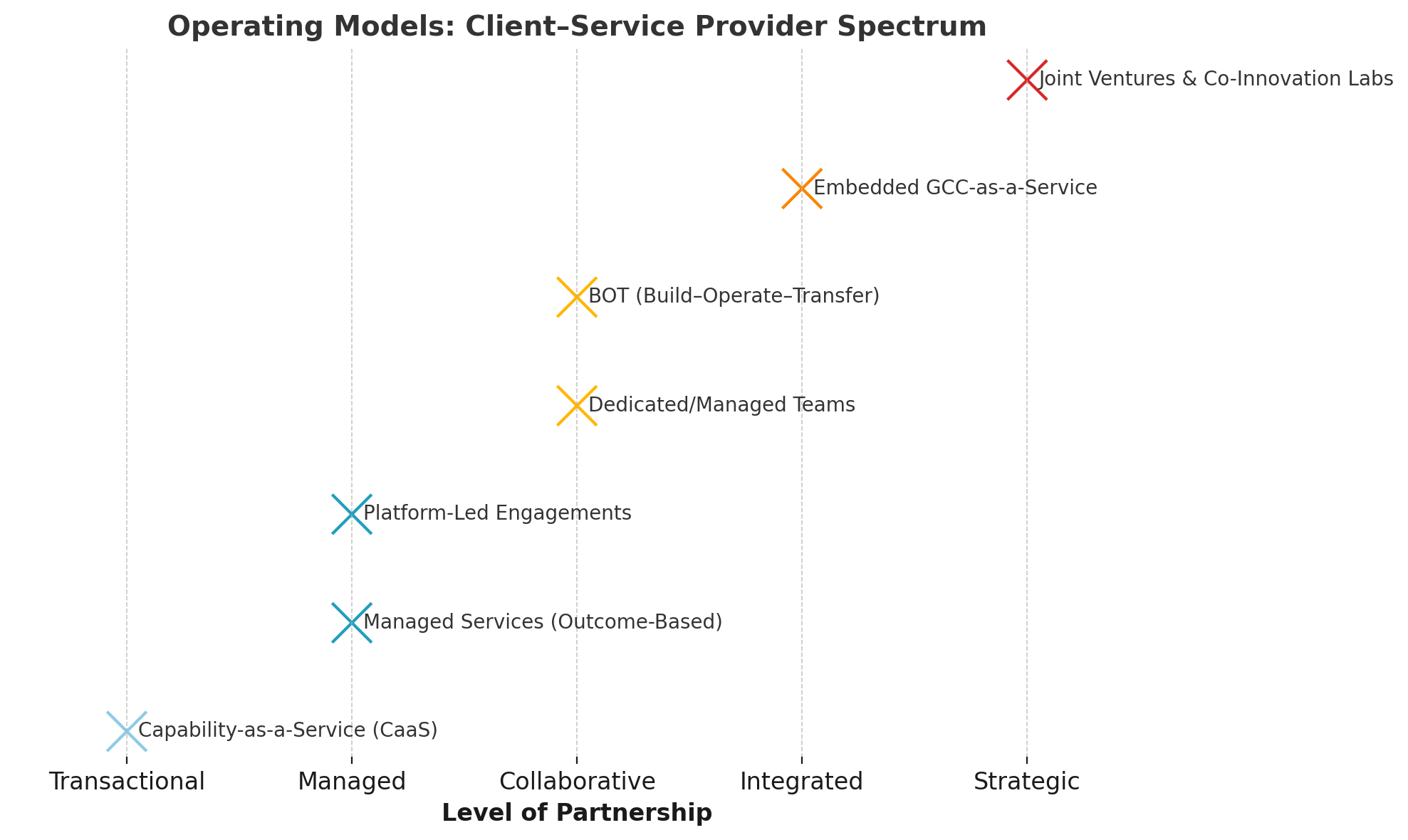

This article explores some common, successful, and emerging operating models between enterprise clients and IT/Analytics/Data services firms, focusing on sustainability, strategic value, and growth potential for the vendor

Established & Common Models

- Staff Augmentation:

- How it Works: You provide individual skilled resources (Data Engineers, BI Analysts, ML Scientists) to fill specific gaps within the client’s team. Client manages day-to-day tasks.

- Pros (Client): Quick access to skills, flexibility, lower perceived cost.

- Pros (Vendor): Easy to sell, predictable FTE-based revenue.

- Cons (Vendor): Low strategic value, commoditized, easily replaced, limited growth per client. Revenue = # of Resources.

- When it Works: Short-term peaks, very specific niche skills, initial relationship building.

- Project-Based / Statement of Work (SOW):

- How it Works: You deliver a defined project (e.g., “Build a Customer 360 Dashboard,” “Migrate Data Warehouse to Cloud”). Fixed scope, timeline, price (or T&M). Build-Operate-Transfer (BOT) model is one such example where you build the capability (people, processes, platforms), operate it for a fixed term, and then transfer it to the client.

- Pros (Client): Clear deliverables, outcome-focused (for that project), controlled budget.

- Pros (Vendor): Good for demonstrating capability, potential for follow-on work.

- Cons (Vendor): Revenue stops at project end (“project cliff”), constant re-sales effort, scope creep risks, less embedded relationship. Revenue = Project Completion.

- When it Works: Well-defined initiatives, proof-of-concepts (PoCs), specific technology implementations.

- Managed Services / Outsourcing:

- How it Works: You take full responsibility for operating and improving a specific function or platform based on SLAs/KPIs (e.g., “Manage & Optimize Client’s Enterprise Data Platform,” “Run Analytics Support Desk”). Often priced per ticket/user/transaction or fixed fee.

- Pros (Client): Predictable cost, risk transfer, access to specialized operational expertise, focus on core business.

- Pros (Vendor): Steady, annuity-like revenue stream, deeper client integration, opportunity for continuous improvement upsells.

- Cons (Vendor): Can become commoditized, intense SLA pressure, requires significant operational excellence. Revenue = Service Delivery.

- When it Works: Mature, stable processes requiring ongoing maintenance & optimization (e.g., BI report production, data pipeline ops).

Strategic & High-Growth Models (Increasingly Common)

- Dedicated Teams / “Pods-as-a-Service” (Evolution of Staff Aug):

- How it Works: You provide a pre-configured, cross-functional team (e.g., 1 Architect + 2 Engineers + 1 Analyst) working exclusively for the client, often embedded within their GCC. You manage the team’s HR/performance; the client directs the work.

- Pros (Client): Scalable capacity, faster startup than hiring, retains control.

- Pros (Vendor): Stronger stickiness than individual staff aug, predictable revenue (based on team size), acts as a “foot in the door” for broader work. Revenue = Team Size.

- Emerging Twist: Outcome-Based Pods: Pricing linked partially to team output or value metrics (e.g., features delivered, data quality improvement).

- Center of Excellence (CoE) Partnership (Strategic):

- How it Works: Jointly establish and operate a CoE within the client’s organization (often inside their GCC). You provide leadership, methodology, IP, specialized skills, and training. Mix of your and client staff. A GCC could have multiple CoEs within it and each client business unit can customize their operating model like BOT, BOTT. In BOTT (Build-Operate-Transform-Transfer), you are adding a transformation phase (modernization / automation) before transfer it to the client to maximize value and maturity.

- Pros (Client): Accelerated capability build, access to best practices/IP, innovation engine.

- Pros (Vendor): Deep strategic partnership, high-value positioning (beyond delivery), revenue from retained expertise/IP/leadership roles, grows as CoE scope expands. Revenue = Strategic Partnership + Services.

- Key for Growth: Positioned for all high-value work generated by the CoE.

- Value-Based / Outcome-Based Pricing:

- How it Works: Fees tied directly to measurable business outcomes achieved (e.g., “% reduction in equipment maintenance downtime,” “$ increase in ancillary revenue per customer,” “hours saved in operations planning”). Often combined with another model (e.g., CoE or Managed Service).

- Pros (Client): Aligns vendor incentives with client goals, reduces risk, pays for results.

- Pros (Vendor): Commands premium pricing, demonstrates true value, transforms relationship into strategic partnership. Revenue = Client Success.

- Challenges: Requires strong trust, robust measurement, shared risk.

Emerging & Innovative Models

- Product-Led Services / “IP-as-a-Service”:

- How it Works: Bundle your proprietary analytics platforms, accelerators, or frameworks with the services to implement, customize, and operate them for the client (e.g., “Your Customer Churn Prediction SaaS Platform + Implementation & Managed Services”). Recurring license/subscription + services fees.

- Pros (Client): Faster time-to-value, access to cutting-edge IP without full build.

- Pros (Vendor): High differentiation, recurring revenue (licenses), strong lock-in (healthy, value-based). Revenue = IP + Services.

- Emerging: Industry-Specific Data Products: Pre-built data models/analytics for client’s domain (e.g., predictive maintenance suite).

- Joint Innovation / Venture Model:

- How it Works: Co-invest with the client to develop net-new data/AI products or capabilities. Share risks, costs, and rewards (e.g., IP ownership, revenue share). Often starts with a PoC funded jointly.

- Pros (Client): Access to innovation without full internal investment, shared risk.

- Pros (Vendor): Deepest possible partnership, potential for significant upside beyond fees, positions as true innovator.

- Cons: High risk, complex legal/financial structures. Requires visionary clients.

- Ecosystem Orchestration:

- How it Works: Position your firm as the “quarterback” managing multiple vendors/platforms (e.g., Snowflake, Databricks, AWS) within the client’s data/analytics landscape (e.g., you integrate cloud platforms, data providers, and niche AI vendors). Charge for integration, governance, and overall value realization.

- Pros (Client): Simplified vendor management, ensures coherence, maximizes overall value.

- Pros (Vendor): Highly strategic role, sticky at the architectural level. Revenue = Orchestration Premium.

Key Trends Shaping Successful Models

- Beyond Resources to Outcomes: Clients demand measurable business impact, not just FTEs or project completion.

- Co-Location & Integration: Successful vendors operate within client structures (like GCCs/CoEs), adopting their tools and governance.

- As-a-Service Mindset: Clients want consumption-based flexibility (scale up/down easily).

- IP & Innovation Premium: Vendors with unique, valuable IP command higher margins and loyalty.

- Risk/Reward Sharing: Willingness to tie fees to outcomes builds trust and strategic alignment.

- Focus on Enablement: Successful vendors actively transfer knowledge and build client capability

The “right” operating model isn’t static – it evolves with the client’s business priorities, tech maturity, and market conditions. Successful partnerships in IT, analytics, and data are increasingly hybrid, combining elements from multiple models to balance speed, cost, flexibility, and innovation.

Forward-looking service providers are positioning themselves not just as vendors, but as strategic co-creators – integrated into the client’s ecosystem, jointly owning outcomes, and driving continuous transformation.