Analytics Industry Study – India – May 2021

You may be an experienced employee in the analytics space or an aspiring Data Scientist/Engineer or an Executive looking up to channelize your investments by creating business use-cases. Technologies like Data/Business analytics, AI/ML/DL, Data Engineering have been thriving in the market in terms of creating better career opportunities, aiding in bringing better customer experiences to your products/services.

According to Allied Market Research firm, the Global Big Data and Business Analytics market size was valued at $193.14 billion in 2019, and is projected to reach $420.98 billion by 2027, growing at a CAGR of 10.9% from 2020 to 2027. It’s promising to see the growth in this industry given that many client organizations are in the process of pivoting to Digital and undergoing a massive digital transformation exercises. This would only attribute to creating more business opportunities that could be uncovered by huge volumes of data using analytics.

In India, according to a recent 2021 study conducted by Analytics India Magazine, the market size of analytics industry in India is about $45.4 billion which has registered a growth of 26.5% YoY (last year, it was $35.9 billion).

There are a few insights I learnt from their study that I would like to share with you today –

- Indian analytics industry to grow to a market size of $98 billion by 2025 and $118.7 billion by 2026

- Analytics accounts for 23.4% in the Indian IT/ITES market size in 2021. This is projected to grow to 41.5% by 2026

- BFSI sector (13.9%) saw the maximum analytics offering contribution compared to other sectors followed by Manufacturing, Retail & E-Commerce, Pharma & Healthcare, FMCG, Telecom, Media & Entertainment, Energy

- Bengaluru (30.3%) is the top-most city in terms of analytics contribution followed by Delhi (26.2%), Mumbai (23.4%)

- Analytics services – more than half (51.6%) of market share received from the U.S. Followed by U.K. (13.2%, Australia (8.3%), Canada (6.4%)

- Among the analytics servicing companies, IT firms dominate the contribution at 43% with leading firms such as TCS, Accenture, Infosys, Cognizant, Wipro, IBM, Capgemini.

With respect to salary compensation, there are a few interesting points to note as well –

- 41.5% of all the analytics professionals fall under the higher income level, greater than 10 Lakhs

- Salary for an Analytics professional is 44% higher than that of a Software Engineer. This could be an attractive proposition for fresh or entry-level graduates to think analytics as a career option.

- Data Engineers (14.9L per annum), Big Data Specialists (14.8L per annum) surpassed the median salary of AI/ML Engineers (14.6L per annum) by a narrow margin.

- Python skill set saw the highest salary followed by SAS/R, QlikView/Tableau, PySpark/Hadoop

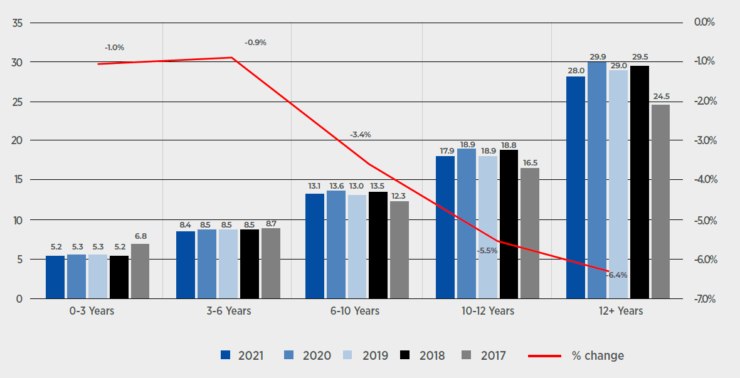

Here’s a break-down of the salary across different experience levels (Source: AIM). Due to several factors such as pandemic salary cuts, the salary during 2021 is slightly lesser than the previous year 2020.

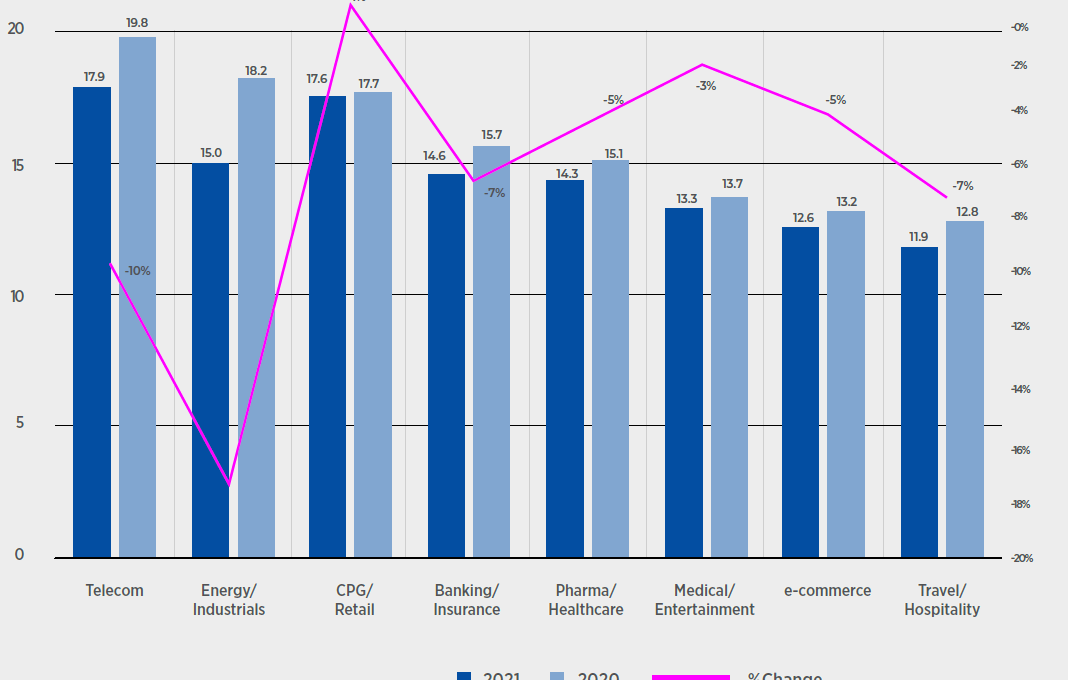

Here’s a look across different industries and how they pay on an average –

Captive Centers, Consulting Firms pay higher than Domestic Firms (like Reliance), Boutique Analytics Firms, and IT Services

Hope this compilation of analytics industry outlook might give you some insights for you to focus and work towards your goals!

Credits: Analytics India Magazine (AIMResearch), Allied Market Research